Long-standing investor wisdom has proven repeatedly that”what goes down must come back up.”

Our goal is to manage your money through all market contingencies. That means both 1) the market’s growth periods and 2) potential downswings due to global scares, such as the Russian/Ukraine war, inflation, and increasing interest rates. In every period, we must apply long-standing experience among all market contingencies where lessons of the past have been learned. Generally, this is why we need a professional advisor who relies on a team of analysts.

Market psychology has studied fear-based over-reaction. Stock markets move, in reality, according to the mass psychology of the people. When most people optimistically believe in a healthy economy, they invest and stay invested. This belief has funded the tremendous advance of our current economy as people continue to invest more of their savings in business ventures using equity investments.

Avoid the dangers of Market Presentism. Presentism is among the most pernicious tendencies of our age. The urge to view current markets only through the present markets’ sentiments and values – for example, Artificial Intelligence (AI) overexcitement about faster information processing – can reflect a lack of perspective. Just as always seeing market history from the standpoint of the now corrupts our understanding of the past, peering ahead can distort our ability to make useful judgments based on historical markets about the future.

Danger can ensue by following the crowd. When many are fearful, the risk of following the crowd is that they can run fearfully out of the market precisely at the wrong moment — increasing their extreme risk of loss. The collective feelings of the masses move market trends up or down.

History has proven that many have lost much of their savings not by staying in the market but by exiting their investment holdings reacting to fear-based news. And many wise investors eventually see their investments return to normal with often better gains in the future.

Your plan was carefully constructed to reflect your objectives and investment time horizon. Market declines may also represent an opportunity to buy quality companies at attractive prices. Warren Buffet, the famous billionaire investor, said:

“It is unwise to be fearful when…others are fearful.”

Avoid greed. When greed sets in during a bull market, investors without the guidance of an advisor can invest based on group gossip or speculation, also by influences on social media. Assess the market with your advisor.

Emboldened by significant returns, retail investors have turned to riskier tools that use leverage to try to magnify their gains and, in the process, their influence over stock markets. Call options, for example, involve placing a bet on a stock rising above a specific price within a particular period. If that bet pays off, the gain can be upward of 10 times greater than simply investing in the underlying stock, depending on the terms of the option contract. If the stock stays below that price, the investor loses the entire amount. 1

The markets witnessed a fantastic recovery since the pandemic fears affected the market in March 2020, rising significantly into 2022.

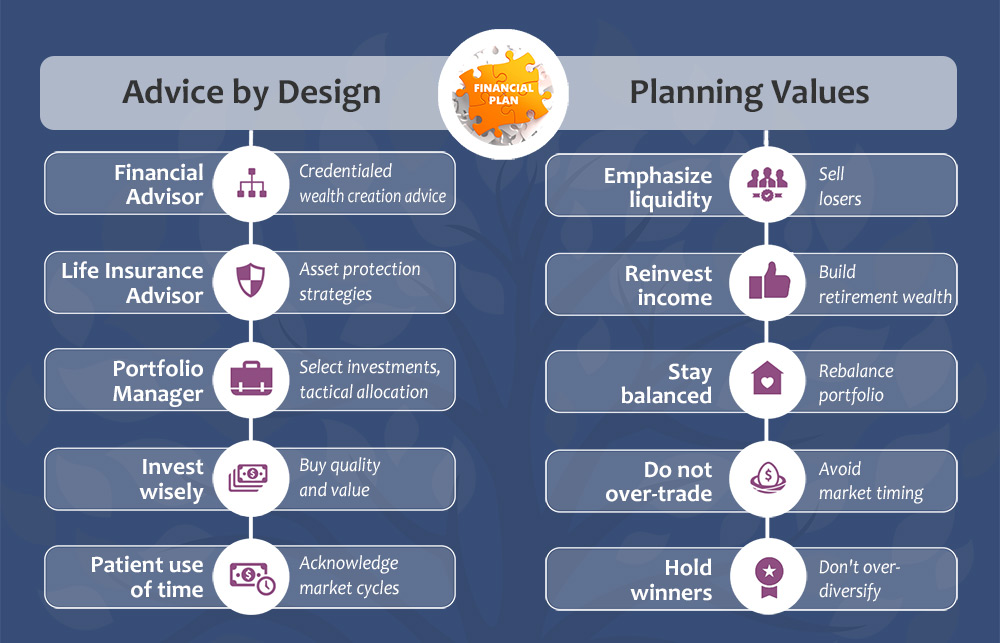

Stay the course. Over the long term, corrections are expected in the investment cycle. Investors who stay invested, instead of allowing fear to cause them to try to time the markets, generally see future increases. The following graph shows financial planning design and values based on investing for future financial security.

1, Globe and Mail