Show all articles

July Newsletter

Personal Wealth and Finance

Estate View

Upon the death of a spouse in Canada, specific rules govern the transfer of Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs) to the surviving spouse. These “rollover” provisions are designed to allow for the tax-deferred or tax-free …

Read more

Estate View

Understanding beneficiary designations in Canada is a critical aspect of estate planning, often overriding provisions made in a will. This is because certain assets, by their very nature, allow for direct beneficiary designations that operate outside of the estate and …

Read more

Estate View

Life insurance needn’t be a boring topic. It’s the foundation of a sound financial plan. Moreover, protecting our family's financial future is of great interest.

Read more

More Recent Articles

Life Insurance

Recent trade policy developments have introduced a degree of market volatility and economic uncertainty. While it’s natural to notice these shifts, it’s important to view them within the broader context of long-term financial planning. For your investment portfolio, these evolving …

Read more

Life View

The "principle of decreasing responsibility" is a financial planning concept that states that an individual who has dependents such as a spouse and/or children has financial responsibilities that life insurance can help meet in the event of death.

Read more

Wealth Viewpoint Quarterly

Understanding transferring RRSPs to RRIFs RRSP Maturity Strategies: You are allowed to contribute to your RRSP up until December 31 of the year that you turn 71, at which point your RRSP must be closed. Instead, you can select any …

Read more

Estate View

Most Canadian Life Insurance companies provide policyholders diagnosed with a terminal illness with some form of early access to a portion of the death benefit. However, the specific terminology, eligibility requirements, and benefit amounts vary considerably. Living benefit, Early Death …

Read more

Investor Insight

The Old Age Security (OAS) clawback, officially known as the OAS recovery tax, reduces the amount of OAS pension you receive if your income exceeds a certain threshold. To avoid or minimize the OAS (Old Age Security) clawback in 2025, …

Read more

Estate View

Life insurance has been called the foundation of your net worth. If you have a spouse or children, the initial stages of your financial strategy should include adequate life insurance coverage.

Read more

Financial Planning

We invest in what people buy. When an equity investment fund or stock is purchased, you indirectly invest in businesses relating to what consumers buy.

Read more

Investor Insight

If you are an investor who remembers the mortgage debt crisis of 2008-9, you know that the stock market lost significant value. From an investment standpoint, the real downside occurred when some investors sold off their equity holdings due to …

Read more

Investor Insight

Canadian legislation enables Registered Education Savings Plans (RESPs) to support education savings for children and grandchildren through specific provisions outlined in the Canada Education Savings Act and related regulations. Facts about an RESP A Registered Education Savings Plan (RESP) is a …

Read more

Registered Investments

RRSP Maturity Strategies: You are allowed to contribute to your RRSP up until December 31 of the year that you turn 71, at which point your RRSP must be closed. Instead, you can select any or a combination of: transferring …

Read more

Life View

As the children get older and move out on their own, and your mortgage and other debts are nearly paid off, the need for life insurance capital designed to replace income for dependents decreases.

Read more

Investor Insight

What are some differences between a Tax-Free Savings Account (TFSA) and a Registered Retirement Savings Plan (RRSP)? The tax benefits of the Tax-Free Savings Account (TFSA) The TFSA is a registered savings account that makes it easy for Canadian taxpayers …

Read more

Financial Viewpoint

Here are some essential strategies that will help you achieve financial independence. It is important to get solid advice to design a plan incorporating planning values such as those noted herein. Separate your savings from your investments. Before investing for …

Read more

Investor Insight

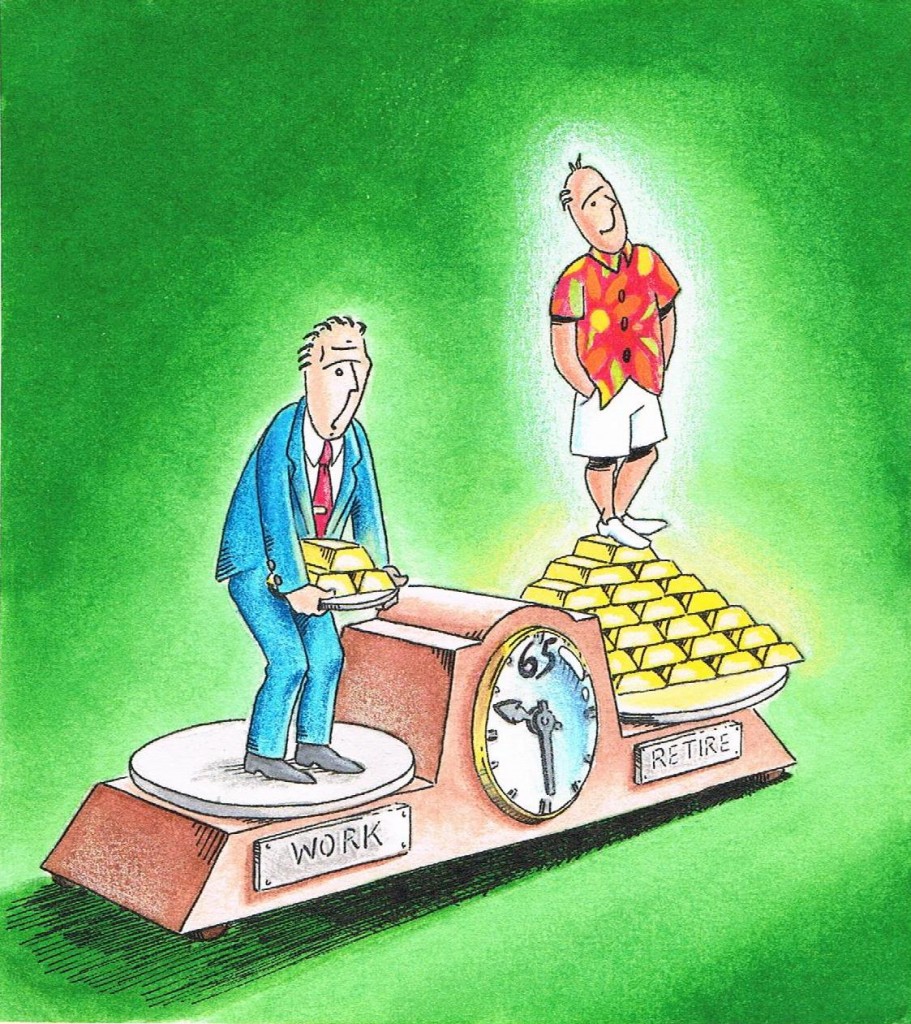

One day your retirement income will flow from the capital you have been saving for years during thirty to forty of your working years.

Read more

Life View

After the death of an individual, every estate must file a final (or 'terminal') tax return. All assets are deemed to be disposed of at time of passing, and this can trigger probate fees and other expenses.

Read more

Investor Insight

Understanding your risk tolerance: Each of us has a personal level of risk tolerance, which indicates how much risk one is willing to take while investing in markets that always go up and down. Your advisor can help you set …

Read more

Newsletter tags

Mutual Funds and Segregated Funds provided by the Fund Companies are offered through Worldsource Financial Management Inc., sponsoring mutual fund dealer. Other Products and Services are offered through Stuart Rowles and Rowles Financial.

Worldsource Financial Management Inc - Disclaimer

Commissions, trailing commissions, management fees and expenses all may be

associated with mutual fund investments. Please read the fund specific

simplified prospectus before investing. Mutual funds are not guaranteed and

are not covered by the Canada Deposit Insurance Corporation (CDIC) or by any

other government deposit insurer. There can be no assurances that the fund

will be able to maintain its net asset value per security at a constant

amount or that the full amount of your investment in the fund will be returned

to you. Fund values change frequently and past performance may not be

repeated.

Labour Sponsored Investment Funds (""LSIF"") have tax credits that are

subject to certain conditions and are generally subject to recapture, if

shares are redeemed within eight years. Please note that Mutual Fund

Representatives in Alberta are not permitted to sell LSIF.

Your Worldsource Financial Management Inc. ("WFM"), mutual fund advisor

maintains business interests that are separate and distinct from his/her

WFM business activities. You will be provided complete information concerning

these outside business interests, including who is responsible for each

business activity. The disclosure will provide you with that information and

will explain your rights and with respect to business that you place with WFM

through your mutual fund advisor. WFM assumes responsibility and liability

for “Worldsource Financial Management Inc. Business Interests” only. All

business activity undertaken by your mutual fund advisor that are not the

specifically designated as “WFM Business Interests” are not the responsibility

of WFM. Therefore, WFM does not assume any liability for any such activity.

The information contained on this Internet Website is for general information

purposes only and is the opinion of the owners and writers. Investors should

educate themselves regarding securities, taxation or exchange control

legislation, which may affect them personally. This web site is for general

information only and is not intended to provide specific personalized advice

including, without limitation, investment, financial, legal, accounting or

tax advice. Please consult an appropriate professional regarding your

particular circumstances.

This Internet Website does not constitute an offer or solicitation in any

jurisdiction in which such offer or solicitation is not authorized or to any

person to whom it is unlawful to make such offer or solicitation.

References in this Internet Website to third party goods or services should

not be regarded as an endorsement of those goods or services. By accessing

any of the links provided you will be leaving the Rowles Financial Website.

Rowles Financial is not responsible for the information contained on these

websites.

All information provided is believed to be accurate and reliable, however,

we cannot guarantee its accuracy. Worldsource Financial Management Inc. will

not be held liable for any inaccuracies in the information presented, nor

will WFM be held liable for any software damages resulting from the use of

this website. Mutual funds are offered only in Canada.

Risk of Borrowing to Invest

Here are some risks and factors that you should consider before borrowing to invest:

Is it Right for You?

- Borrowing money to invest is risky. You should only consider borrowing to invest if:

- You are comfortable with taking high risk.

- You are comfortable taking on debt to buy investments that may go up or down in value.

- You are investing for the long-term.

- You have a stable income.

You should not borrow to invest if:

- You have a low tolerance for risk

- You are investing for a short period of time.

-

You intend to rely on fund distributions / income from the investments

to pay living expenses.

-

You intend to rely on fund distributions / income from the investments to

repay the loan. If this income stops or decreases you may not be able to

pay back the loan.

You Can End Up Losing Money

-

If the investments go down in value and you have borrowed money, your

losses would be larger than had you invested using your own money.

-

Whether your investments make money or not you will still have to pay back

the loan plus interest. You may have to sell other assets or use money you

had set aside for other purposes to pay back the loan.

- If you used your home as security for the loan, you may lose your home.

-

If the investments go up in value, you may still not make enough money to

cover the costs of borrowing.

Tax Considerations

- You should not borrow to invest just to receive a tax deduction.

-

Interest costs are not always tax deductible. You may not be entitled to a

tax deduction and may be reassessed for past deductions. You may want to

consult a tax professional to determine whether your interest costs will be

deductible before borrowing to invest. Your advisor should discuss with you

the risks of borrowing to invest.